Download Entire report

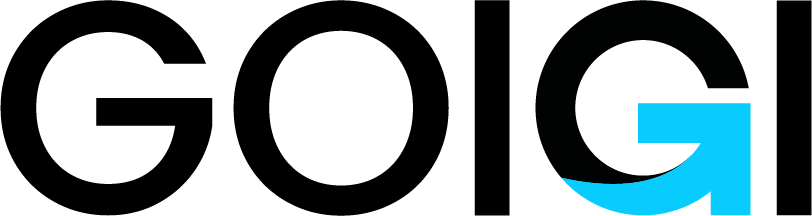

Pay $4.99The Global steel market size reached to $ 942.3 billion in 2023 and the market is anticipated to grow at a CAGR of 3.05% from 2024 to 2032, when it reaches $ 1,234.8 billion

The slump in residential building caused by exorbitant loan rates and building expenses has reduced demand for steel in the majority of the major steel-consuming regions

Due to the delayed effects of monetary tightening, housing activity in the US, China, Japan, and the EU is predicted to decline in 2023 and to remain poor in most key countries well into 2024

In 2023, the world's steel demand was further hindered by sluggish global demand, high costs and uncertainties associated with manufacturing, and restrictive financing circumstances

Global steel demand in 2023 has been supported by robust investment activity in manufacturing facilities and public projects; investment in manufacturing is done to develop strategic sectors

These technologies cover a wide spectrum of cutting-edge strategies meant to lessen the industry's need on conventional, carbon-intensive production techniques & adoption of hydrogen based reduction

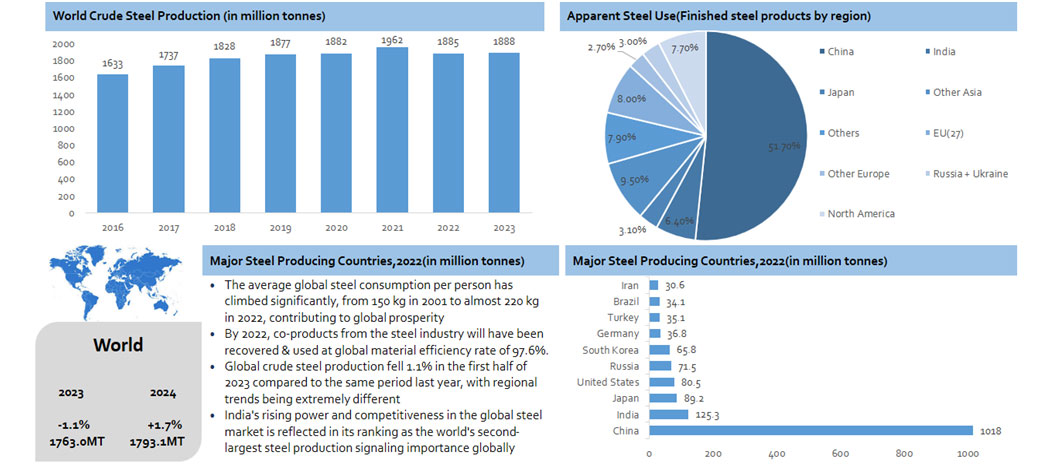

Integration of the circular economy represents a break from the "take-make-dispose" linear paradigm in order to reduce waste and maximize resource efficiency, the industry is implementing a closed-loop

Steel producers benefit from the current infrastructure development initiatives being carried out by governments and non-governmental bodies; investments in energy, transportation & modern infrastructure, provides a consistent demand

The demand for specialty steels used in battery production, wind turbines, and solar panels is driven by the trend towards EVs and renewable energy sources and steel makers can get benefit by creating lightweight, high-performance steel alloys

The global steel industry has been experiencing persistent overcapacity, especially in places like China, which has resulted in price instability and heightened competition which reduces profitability and financial strain for steel producers

The global steel market is disrupted by the imposition of tariffs and trade obstacles by different governments; international trade flows are hampered, uncertainty is raised, and pricing dynamics are distorted by these protectionist policies.

The unpredictability of world politics & central banks‘ policy of raising key rates

China's construction industry is just slowly recovering; the March–April peak season was originally anticipated; the PRC, lowering demand for steel goods and making the iron ore market outlook less positive

Following Russia's invasion of Ukraine, raw material costs have increased significantly for Indian steel industries

Imports become more costly and exports less expensive when the currency is weaker. On the other hand, a stronger currency may increase the cost of steel exported by nations, which could have an impact on global demand and pricing.

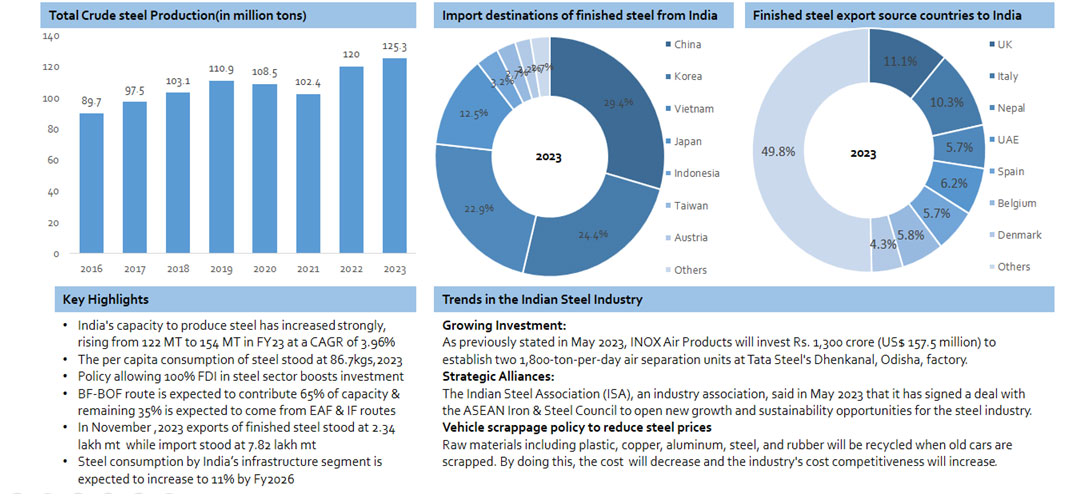

Steel consumption by India’s infrastructure segment is expected to increase to 11% by Fy2026

1. Industry Overview

2. Industry Market Size

3. Market Insights

4. Industry Trends

5. Industry Business Models

6. Pricing Insights

7. Business Models

8. Opportunities and Challenges

9. Recent Updates

10. Competitive Benchmarking

11. Company Analysis(1/4)

12. Company Analysis(2/4)

13. Company Analysis(3/4)

14. Regional Insights- India

15. Regional Insights- USA

16. Regional Insights- USA

17. Porter Five Forces Analysis

18. SWOT Analysis

19. Company Segmentation

Download Entire report

Pay $4.99Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.

Contact Us Today, And Get Reply Within 24 Hours!

Thank you! We have received your message. You will soon hear back from us.