Industry Overview:

The global ed-tech market size was valued at $222.4 billion in 2023 and is expected to grow at a CAGR of 14.09% during 2024-2032 reaching $661.2 billion by 2032

Industry Trends:

- Rapid technological advancement, digitization of businesses, upskilling & low cost of broadband connectivity helped the ed-tech sector boom with high investment

- Edtech companies are looking to M&A in an effort to achieve economies of scale, as they search for long-term solutions to reduce the industry's challenge with high customer acquisition costs (CAC) and to have lifetime value of customers exceed CAC

- Large employers have invested in workforce development to fill talent gap and to meet this demand of upskilling & reskilling, edtech companies are expanding their offerings

- Due to the mounting legal challenges facing the Chinese edtech sector, major firms including as Udacity, Coursera & edX, have invested in the vast Indian market

- Learners want value added services like personalized mentoring, interview preparations & job support; to provide this holistic experiences firms are expanding their resources

Market Insights:

Digital learning resources are used by 64% of middle school pupils in the United States daily and 42% of businesses reported higher revenue following the implementation of e-learning

Opportunities:

Personalized Learning Platforms

Personalized learning platforms driven by AI may evaluate each learner's learning preferences & needs to tailored their specific abilities

AI Powered Tutoring Platform

Combination of learning resources & cheap, easily accessible personalized feedback might be created by combining the chatbot with normal digital educational content

Skill Based Learning Apps

The constantly shifting nature of job landscape demands skill development, which paved the way for skill based learning with thousands of potential niches

Collaborative Learning Platforms

Collaborative platform combines industrial expertise & knowledge leading collaborative working apps that have potential can succeed & add significant value in edtech sector

Consumer Analysis:

Ed-tech market highlights-USA:

The US leads the world in venture capital funding for edtech startups with $8.3 million, more than $5.9 million more than second place China

With more than $400 million in funding, online learning startup 2U topped the list of edtech companies in the United States. It came in fourth place worldwide

With 155, New York City was shown to have the world's largest density of edtech businesses ,respectively, San Francisco and Chicago are rated 2nd& 3rd

One of the major suppliers, Duolingo, introduced a new subscription package in March 2023 that included access to a GPT-4-powered AI instructor and two additional AI-powered features dubbed "Roleplay" and "Explain My Answer"

1,385 edtech businesses in the United States, which makes up 43% globally

1. Industry Overview

- 1.1. Revenue in the online education market(in $ billion )

- 1.2. Edtech and Smart Classroom market by region,2022share

- 1.3. Top Edtech Tools

2. Industry Market Size

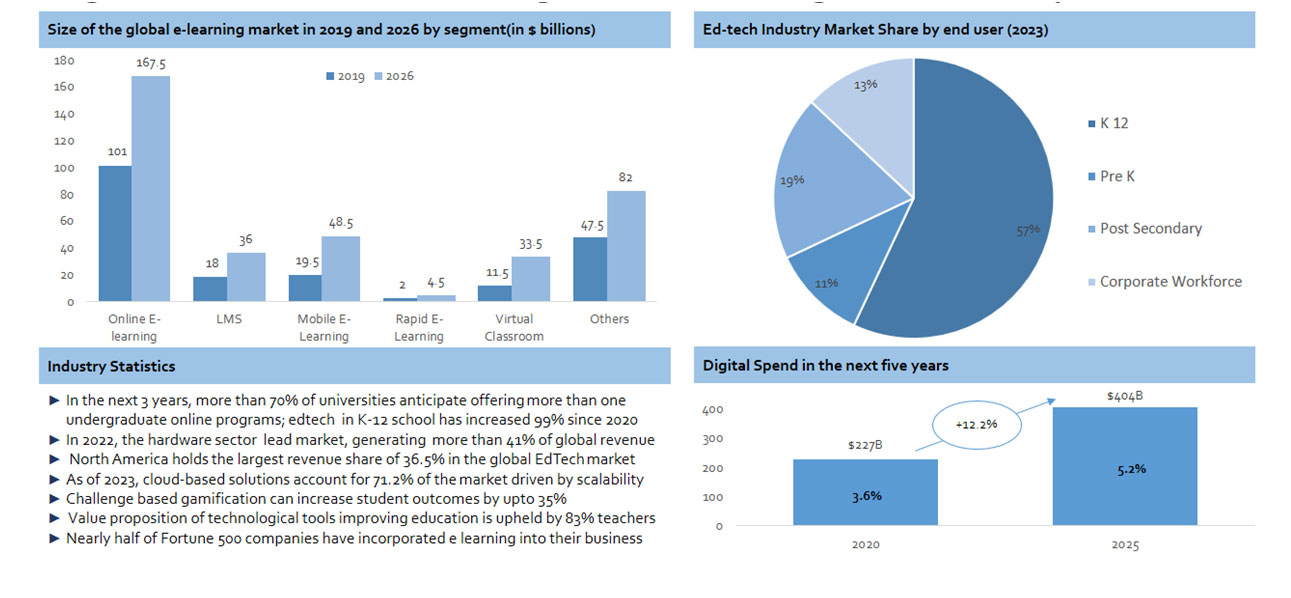

- 2.1. Size of the global e-learning market in 2019 and 2026 by segment(in $ billions)

- 2.2. Edtech Industry Market Share by end user (2023)

- 2.3. Industry Statistics

- 2.4. Digital Spend in the next five years

3. Industry Trends

- 3.1. Industry Trends

- 3.2. Growth in Advanced Technology Expenditure in Global Education

- 3.3. Future Trends in the Industry

4. Market Insights

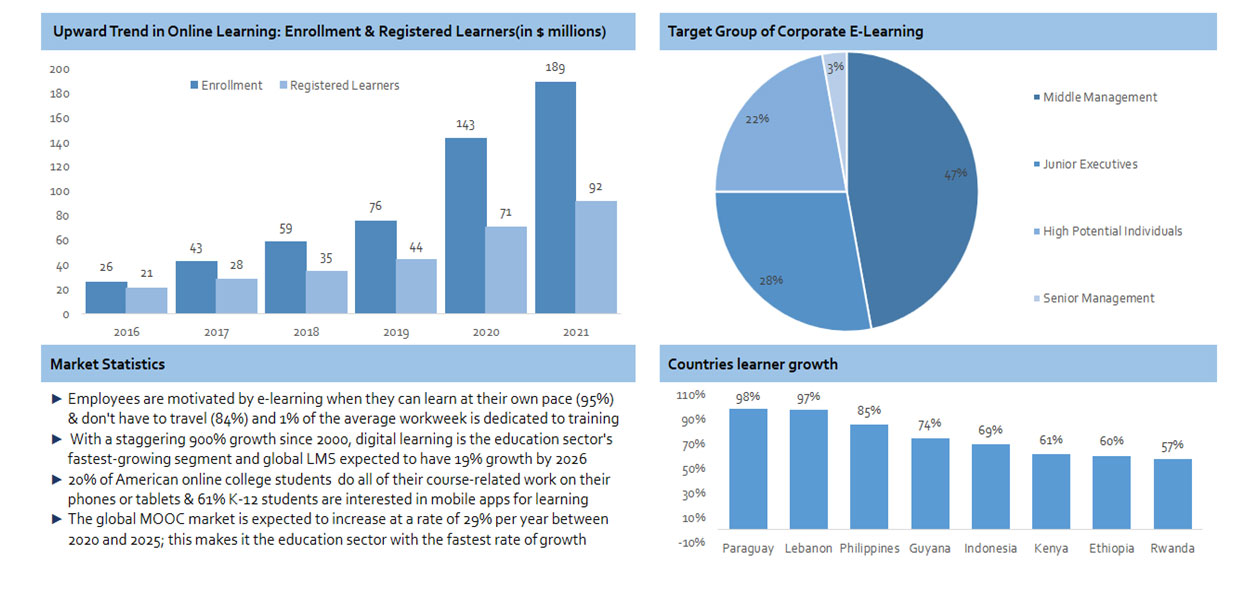

- 4.1. Upward Trend in Online Learning: Enrollment & Registered Learners(in $ millions)

- 4.2. Target Group of Corporate E-Learning

- 4.3. Market Statistics

- 4.4. Countries learner growth

5. Business Models

6. Opportunities & Challenges

- 6.1. Opportunities

- 6.2. Challenges

- 6.3. Edtech Market Growth: Grade 1-12(in $Mn)

- 6.4. Edtech User Growth Rate: Grade1-12

- 6.5. Ed Market by deployment mode

7. Consumer Analysis

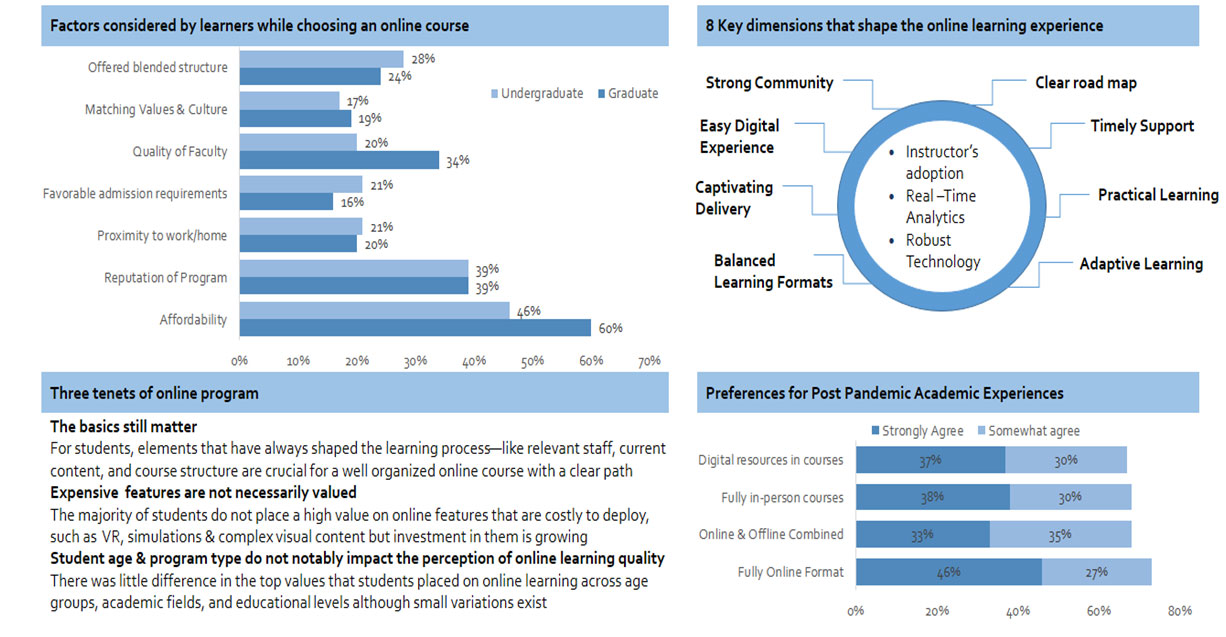

- 7.1. Factors considered by learners while choosing an online course

- 7.2. 8 Key dimensions that shape the online learning experience

- 7.3. Three tenets of online program

- 7.4. Preferences for Post Pandemic Academic Experiences

8. Cost Analysis

- 8.1. Forecasted Expenditure on education technology worldwide(in billions)

- 8.2. Expense Breakdown : Vedantu

- 8.3. Factors affecting Customer Acquisition Cost(CAC)

- 8.4. Expenditure breakdown: Coursera

9. Competitive Benchmarking

10. Company Analysis(1/4)

- 10.1. Revenue by Source(in $ million)

- 10.2. Coursera Users by Country(in millions)

- 10.3. Key Elements of Growth Strategy

- 10.4. Catalogue Statistics

- 10.5. Key Highlights

11. Company Analysis(2/4)

- 11.1. Revenue by Segments(in $ million)

- 11.2. Udemy Web Traffic by country

- 11.3. Growth Strategies

- 11.4. Revenue by Segments

- 11.5. Key Highlights

12. Company Analysis(3/4)

- 12.1. Revenue breakdown(in ₹ crore)

- 12.2. Upgrad Web Traffic by country

- 12.3. Growth Strategies

- 12.4. Revenue by Segments

- 12.5. Key Highlights

13. Company Analysis(4/4)

- 13.1. Income breakdown(in ₹ crore)

- 13.2. Unacademy Web Traffic by country

- 13.3. Growth Strategies

- 13.4. Revenue by Segments

- 13.5. Key Highlights

14. Regional Insights- USA

- 14.1. Revenue of the edtech market (in billion USD)

- 14.2. Edtech Users (in millions USD)

- 14.3. Edtech Market Highlights

- 14.4. U.S Edtech Investment Total(in billion USD)

15. Regional Insights- India

- 15.1. Market size by segment

- 15.2. Top 10 ED-tech funding, 2022(Total: $ 1842 million)

- 15.3. Highlights of Indian Ed-Tech Industry

- 15.4. Share of Ed-Tech consumers in India as of January 2023, by type

16. SWOT Analysis

17. Porter Five Forces Analysis